Science and investing seem like separate fields that have little to no common overlap. However, both fields are broad and varied. Science includes anything that involves learning about the natural and social world through observation and experimentation. It can be driven by curiosity, with the goal of expanding our scientific knowledge. Science can also be driven by problem solving, with the goal of finding solutions that can result in new products and services introduced into the economy. But, to be viable in the economy, these new products and services may require resources such as money, labor, and time. Investments in these new products and services can provide the necessary resources to ensure viability, with the expectation of earning an income or profit.

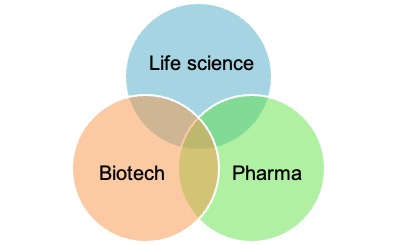

New products and services from scientific problem solving can emerge in just about every industry. The life science industry is rich in scientific advancements that result in new products and services, which are popular investments. However, the life science industry overlaps and blends with biotech and pharmaceuticals.

The life science industry

Companies within the life science industry dedicate their efforts to improving the lives of organisms. This is a really broad category because it includes not just humans but animals as well. A company developing a drug to treat cancer would be considered a life science company. A company using AI to improve speech therapy for people with disabilities is also a life science company. A company dedicated to producing meatless food products from mushrooms would also be considered a life science company. A company focusing on improving technologies for diagnosing animal health problems is also a life science company. Thus, the life science industry includes a diverse collection of companies.

The biotechnology industry

Biotechnology focuses on leveraging an understanding of the natural sciences to create solutions for improving human health. This can include understanding and leveraging concepts in genetics, microbiology, animal cell cultures, molecular biology, embryology, and cell biology. A company developing genetically modified mice for use in drug discovery would be an example of a biotech company. A company developing methodologies for treating infertility could be considered a biotech company. There are a lot of similarities between life science and biotech companies. In fact, biotech and life sciences are terms that can be used interchangeably, and biotech can be viewed as an industry within life sciences.

The pharmaceutical industry

Traditionally, pharmaceutical companies were companies that developed small molecule drugs for the treatment of diseases and disorders. Over the last few decades, therapeutic drugs have expanded beyond small molecules. Antibodies, fusion proteins, and oligonucleotides have emerged as therapeutics for treating diseases and disorders. Many pharmaceutical companies have more than small molecules in their pipelines and as marketed products. Pharmaceutical companies have also expanded by developing biotech tools to aid in drug discovery, blurring the distinction between pharmaceutical companies, biotech companies, and life science companies.

Although life sciences, biotechnology, and pharmaceuticals have different names, there is a lot of overlap and blurred boundaries between these industries. As science advances and progresses, these industries have blurred. Thus, the terms life sciences, biotech, and pharmaceuticals can be used interchangeably.

Within these industries, life sciences, biotechnology, and pharmaceuticals, there are numerous niches. Medical devices are a niche within life sciences, biotech, and pharmaceuticals. Diagnostic assays are also a niche. Therapeutics and modalities are also a niche. At the root of each of these niches are very specific sciences. Understanding any niche and how investment in a niche can possibly yield income or profit requires an investigation and education into the root sciences.

Therapeutics and modalities are a niche with high investment interest. Companies developing and commercializing a therapeutic could be viewed as a life science company, a biotech company, a pharmaceutical company, or all three. If the product being developed or commercialized is a therapeutic, then the company falls within the blurred boundaries of these industries. These therapeutic companies are attractive to investors, investment banks, and other companies to possibly acquire. For example, AbbVie’s Humira antibody product made $22 billion in 2022. A small therapeutics company, RayzeBio, which develops radiopharmaceuticals, was acquired by Bristol Myers Squibb for $4.1 billion in December 2023.

At the root of the therapeutics and modalities niche lies a complicated science based on biology, chemistry, cell biology, genetics, biochemistry, anatomy, etc. It would take several semesters of college-level courses to understand the necessary science. Even then, a complete understanding would be lacking, as college-level courses rarely cover cutting-edge science. Luckily, there is a course designed for investors, lawyers, consultants, executives, and other professionals working in the life sciences, biotech, or pharmaceutical industries. The Executive Course on Therapeutics and Modalities provides an understanding of the science found at the root of this niche, covering the basics of large molecules, small molecules, gene therapy, cell therapy, and RNA therapy. The course can be leveraged by the solo learner, or it could be used to train teams at investment firms, venture capital groups, law firms, etc.